Article Direction

Auto loan integration concerns taking right out a unique loan and utilizing they to repay a couple of car loans. You can consolidate automobile financing along with other variety of fund. Rather than balancing several money, integration means you can only need to build one to payment. In certain situations, you might also have the ability to save money through getting a beneficial lower interest rate.

What exactly is car loan consolidation?

Merging personal debt form taking out an alternate loan and ultizing brand new finance to settle particular (otherwise most of the) of your present debts. In place of overseeing several costs, you might get one simplistic monthly payment. Car finance consolidation isn’t any different. If that’s the case, at least one of your expense you’ll pay off might be an auto loan.

Having site, there is no such as for instance material as the a faithful automobile consolidation mortgage. However, you can utilize debt consolidation reduction fund and other borrowing products to have that it objective, eg:

Merging automobile financing versus. refinancing

.jpg/640px-SanBernardinoStationStreetside_(cropped).jpg)

You might envision refinancing rather. Refinancing an auto loan pertains to taking out fully a special mortgage in order to pay you to definitely loan, not several expense. The goal is simply to secure a much better interest rate or so much more positive loan words.

There are even some differences in exactly how this type of fund is structured. Auto re-finance fund typically make use of the vehicles because collateral so you can secure the loan. In this case, the financial institution performs smaller chance, because contains the straight to repossess the automobile for people who end and come up with money. Thus, you could potentially typically assume a lower interest.

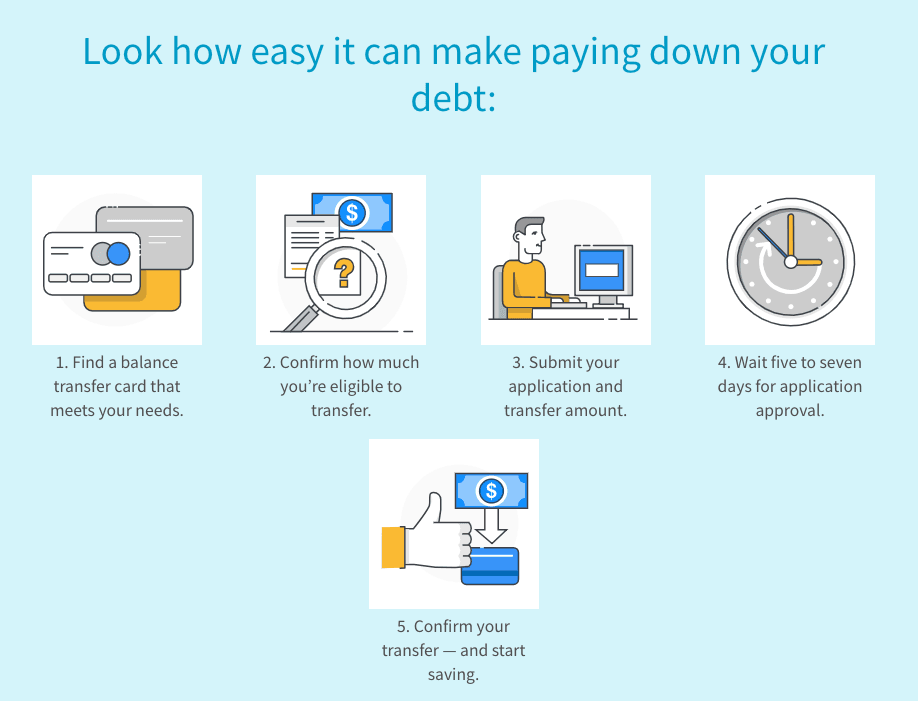

Ideas on how to consolidate automotive loans

Now you understand a little more regarding car combination funds as well as how they work, let’s look closer on how to combine automotive loans. Usually out of thumb, the process will most likely go after these types of measures:

Basically, you might have only one auto loan per car. Although not, you can use most other financial devices to combine several automotive loans into one when needed. Listed here is a peek at the options:

Personal loans

Really loyal debt consolidation funds try a type of unsecured loan. A personal loan is actually a kind of payment mortgage one normally includes repaired monthly obligations.

High interest rates: Given that unsecured loans are unsecured, might likely feature a high rate of interest than simply a loan that requires collateral.

House collateral mortgage or HELOC

Into one-hand, a home collateral mortgage really works such as an unsecured loan. In this case, you get the funds within the a lump sum payment and stay asked and work out regular money towards both dominant and you will interest. Concurrently, property security line of credit (HELOC) really works similar to a charge card. With this specific unit, you can borrow against your house equity as required to have a flat time. Additionally, you will only pay focus for the number which you have borrowed.

Both issues make use of house because the security so you can hold the loan. Quite often, this can help you borrow funds in the a considerably down interest rate. not, it means that the lending company is also foreclose on your house if you cannot keep up with your repayments.

Chance of property foreclosure: The financial institution normally repossess your residence if you find yourself incapable of take care of the monthly installments.

Balance import credit cards

Even though some loan providers will get enables you to pay back your car financing that have a balance transfer credit card, it is best to proceed with warning. Even though many of those notes can come which have a tempting 0% Apr introductory rate months, the individuals just continue for 18 so you can 21 cash advance Dayville CT days at the most. If you can’t pay it back prior to upcoming, you can also face highest rates than simply you’ll that have another type of type of financing.

Commentaires récents