Regulation Z’s Truth into the Credit Act

Observed from the Controls Z, the fact inside Lending Work was developed from inside the 1968 due to the fact a beneficial cure for manage consumers out-of malicious, dubious, otherwise unjust strategies by the lenders or any other financial institutions. Loan providers must make complete disclosures from the rates of interest, fees, regards to borrowing from the bank, and other arrangements. They want to also provide customers towards actions they should test document an issue, and you can grievances should be looked after promptly. Borrowers can also terminate certain kinds of fund contained in this a designated time period. Which have all this recommendations on their fingertips gets consumers a great cure for shop around for the best you can rates and you will lenders regarding borrowing from the bank money otherwise taking credit cards.

A home Payment Methods Act (RESPA)

That it act handles brand new relationships ranging from lenders and other real house gurus-principally real estate agents-in order that no parties discover kickbacks to have encouraging people so you’re able to explore particular home loan characteristics. The new work as well as prohibits financial institutions out-of making need to have higher escrow accounts, while you are restricting suppliers from mandating label insurance vendors.

Who Enforces Home loan Statutes?

An individual Economic Safeguards Agency (CFPB), an independent government service, was created to give just one part of responsibility so you can demand financial and you may user safety laws. The fresh new Government Put aside including supervises new financial community, and therefore reaches mortgage lenders. The new You.S. Agencies off Housing and you may Metropolitan Innovation (HUD) manages Federal Houses Government (FHA) software, that have considering $1.3 trillion from inside the home loan insurance in order to homeowners. This new FHFA manages those activities of mortgage markets liquidity company Fannie Mae and Freddie Mac computer.

Exemplory instance of Financial Controls

According to citation, outcomes out-of violating home loan financing rules vary wildly. Particularly, if a lender is located to be in willful ticket regarding new TILA, they are able to actually become imprisoned for approximately one year. Although not, typically the most popular effects is actually monetary penalties. TILA abuses often carry penalties and fees doing $5,000. While doing so, much more serious instances may result in long lasting exception regarding mortgage credit world.

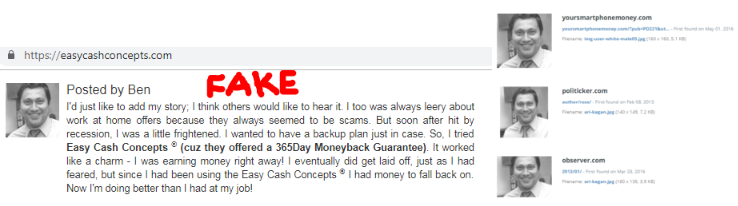

Check out the matter-of RMK Economic Business and that did organization less than the name Majestic Lenders. RMK is actually quoted while the giving advertising so you’re able to armed forces family members, misleading borrowers to think the firm is associated with brand new You.S. bodies. From inside the 2015, RMK is actually issued an agency buy in order to prohibit including things.

Along the next several years, RMK reportedly proceeded so you can ilies and additionally having fun with fake U.S. Institution out-of Veteran Points seals, playing with FHA logos, and making use of words LA payday loan no direct deposit so you’re able to suggest the corporate framework. Such actions have been brought to hack consumers in the rates, words, financing requirements, or estimated possible discounts when refinancing.

Within the 2023, new CFPB forever prohibited RMK regarding mortgage credit industry. The latest regulatory agencies said the methods would be to end repeat culprits and long lasting steer clear of the providers out of engaging which have for example consumers. Including are blocked away from advertisements, revenue, producing, providing, offering, otherwise offering mortgage loans. RMK has also been given an effective $one million good become given out so you’re able to CFPB’s sufferers relief finance.

Processing a grievance

Customers with grievances from the mortgage brokers will be very first reach out to this new CFPB through the agency’s webpages. It includes customers with numerous equipment to address lending grievances. Brand new Government Set-aside, the fresh new Government Deposit Insurance policies Corp. (FDIC), plus the Federal Borrowing Commitment Management (NCUA) including invite consumers to make contact with all of them regarding home loan company complaints.

Up until now, the sole home loan laws and regulations with altered as a result of the 2020 financial crisis was regarding home loan upkeep and you may forbearance. If you are changes still would be put in place to adjust mortgage lending laws and regulations, not one are currently toward books.

Commentaires récents